Kelowna’s Market vs. the Numbers – What’s Really Happening?

- Mark Coons

- Feb 26

- 2 min read

The Central Okanagan Economic Development group just released its 2024 Economic Indicators, and in a period of ongoing change, Kelowna continues to show resilience despite a number of challenges.

Here are my top five takeaways from the report: View Report Here

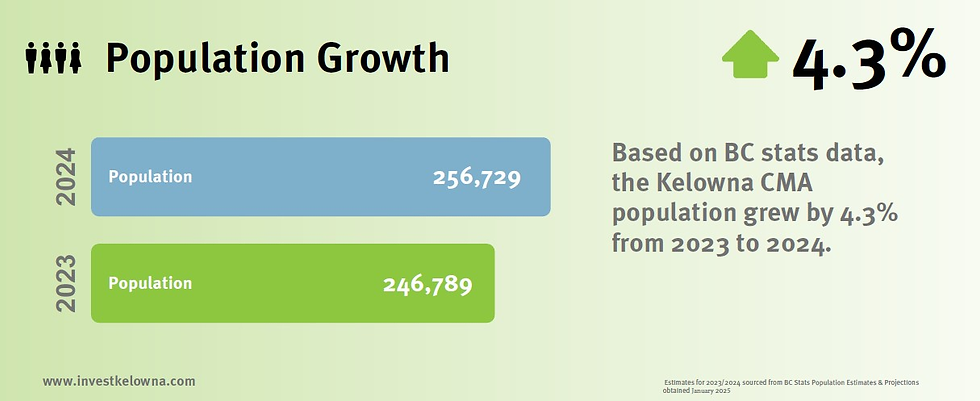

Kelowna is still growing, which shouldn’t come as a surprise, but with 4.3% population growth, it’s further confirmation that the Okanagan remains a highly desirable place to live. While we are seeing interprovincial migration continue to leave BC, Kelowna is still growing and in need of more housing.

The unemployment rate sits at 4.7%, down from last year’s 3.1% but still well below Canada’s national average of 6.7%. While job postings declined by 15.9%, employment remains steady across multiple sectors, with demand still strong in retail, healthcare, and trades.

Despite short-term rental restrictions and the impacts of the 2023 wildfires, Kelowna International Airport (YLW) saw a record year, with a 5.4% increase in passengers totaling 2.13 million travelers. This continued growth in air travel is a positive indicator for tourism and overall economic activity in the region.

On the housing side, home prices have been a major talking point over the years, but what’s interesting is how Kelowna’s growth has outpaced many other major cities. Back in 2019, the median newly constructed home price was $950,000. Fast forward to today, and that number has jumped to $1,580,000. In comparison:

- Kelowna (2024): $1,580,000

- Toronto: $1,407,500

- Calgary: $730,000

- Vancouver: $2,500,000

in comparison to 2019 :

However, I do have some concerns with these housing numbers and have noticed a few discrepancies. According to CREA, the benchmark price in January 2025 is quite different from what’s reflected in the report:

Calgary: $573,100

Greater Vancouver: $1,173,000

Toronto: $1,070,100

Interior: $653,500

These numbers present a different picture when comparing Kelowna to other major markets. While the report suggests that new home prices in Kelowna are outpacing Toronto, CREA’s data tells a different story. This raises the question of whether we’re looking at the full picture when it comes to how Kelowna fits into the broader market landscape.

And maybe this sheds some light an important factor of housing, something that needs to be addressed, which is its build costs in the Okanagan, having higher build costs than Vancouver. According to the COED Kelowna’s new home prices has increased $630,000 in the last 6 years.

What does this mean for the market? Historically, Kelowna had a price gap that made it attractive to buyers from Toronto and Vancouver looking for value. With that gap shrinking and/or closed in some cases, out-of-town buyers populations may continue to decrease as there is not the same value difference (newer and cheaper than their existing residence). That said, it also reinforces Kelowna’s position as a strong and growing market that continues to attract demand and for the ones that are driven by the lifestyle in the Okanagan, there are still other housing options where it makes sense.

With all these factors at play, real estate decisions need to be made with the bigger picture in mind. If you're wondering how this affects your plans, whether buying or selling, let's connect.

Have a great week!

Mark and Maddie Coons

778-744-0872

Comments